Car Calculator Funny Cars for Sale

The golden rule of car buying is that the car's price should not exceed 35% of your gross annual income. It's also better to finance used than to lease new.

The realization that it's time to buy a car probably comes with an equal mix of excitement and trepidation.

On the one hand, you have a nice, new car to look forward to — heated seats, Apple Carplay, and more.

But on the other hand, you're doing mental stretches getting ready for all the hoops you'll have to jump through before getting the keys:

- How do you determine your budget?

- Should you lease or finance the car?

- If you can afford to pay cash, should you?

- What loan terms should you go for?

- And finally, how can you get the best possible deal on the car?

By the end of this piece, you'll have the answers to all of these questions and more!

Here's how much car you can afford

Follow the 35% rule

Whether you're paying cash, leasing, or financing a car, your upper spending limit really shouldn't be a penny more than 35% of your gross annual income.

That means if you make $36,000 a year, the car price shouldn't exceed $12,600. Make $60,000, and the car price should fall below $21,000.

And so on.

Now, 35% is an upper spending limit. Not everyone should spend over a third of their income on a car. Folks who just want something to ferry them to work will be perfectly happy spending way less, while anyone who grew up watching Top Gear will likely want to spend closer to the limit.

Which tier do you fall into?

| Tier | Description | Spending limit |

|---|---|---|

| The Frugal Commuter | "I just need something reliable to get me to work. Nothing fancy." | 15% |

| The Compromiser | "I'd like some creature comforts — maybe a good sound system and heated seats." | 25% |

| The Enthusiast | "I love cars and driving, and want my whip to be as fun/luxurious as possible within budget." | 35% |

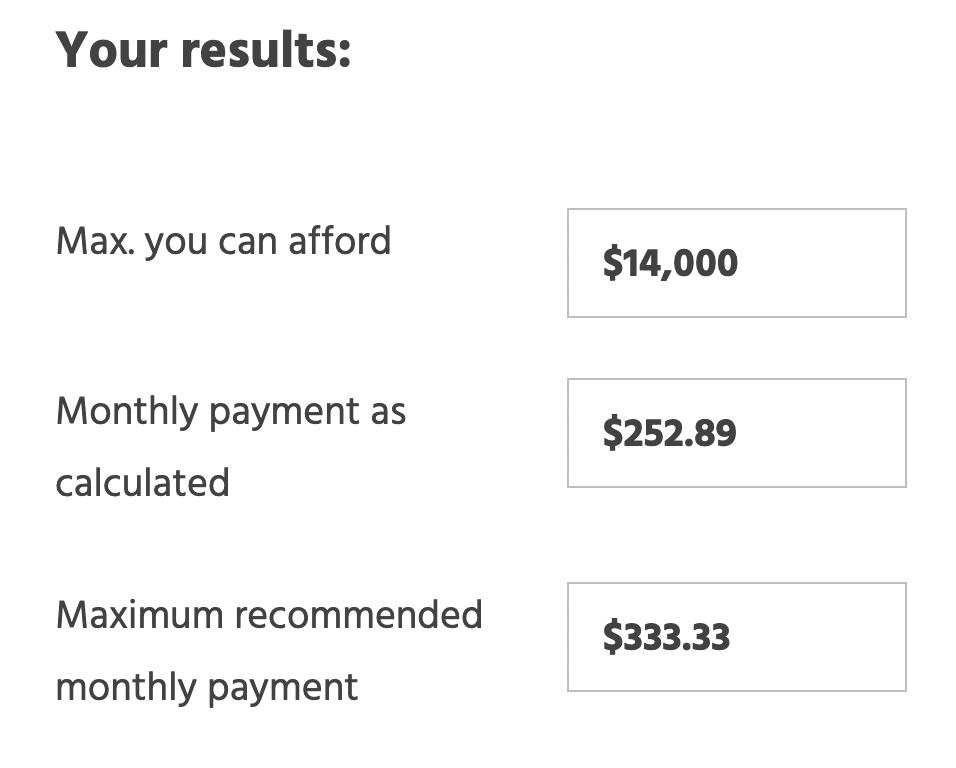

You can tinker with the Money Under 30 Car Affordability Calculator to get your exact numbers:

How to use the Money Under 30 Car Affordability Calculator

Let's pretend that you make $40K a year. Your budget is 35% or $14,000, and you plan to make a 20% down payment of $2,800. You don't have a trade-in, and you choose a 48-month loan at 4%.

Punch in those numbers and scroll to the bottom, where you'll see an all-important number: Maximum recommended monthly payment. Since we stayed within budget and put 20% down, we're ~$80 below our maximum recommended payment — a good place to be.

Should you buy or lease a car?

Now, let's talk about buying versus leasing.

We know why a lease can be tempting — you get a brand new car for a lower monthly payment than a car loan. What's not to like?

Well, at Money Under 30, we're torn on the idea of leasing a car . Leases are riddled with hidden costs that drive up the monthly payment, such as higher insurance rates, mileage charges, and the results of the dreaded credit card test , where the dealer will charge you for every nick and scratch bigger than a credit card.

As a result, Allyson Baumeister, a member of the Texas Society of Certified Public Accountants, says:

"Buying a car is almost always better than leasing."

Read more: Why you should (almost) never lease a car

The two times leasing might make sense

All that being said, there are two cases in which leasing might make sense.

- You only need a car for three years. To be clear, this method isn't necessarily cheaper than buying used — but it is a bit more convenient. If you don't want the hassle of having to sell a used car, leasing might be the way to go.

- You gotta have that new car smell. If you can't bear the idea of driving a used car, but also can't afford to finance a brand new one, leasing might be an option. But we still recommend that you convince yourself that a used car is the better move.

Should you pay cash or finance a car?

If you can afford to pay cash, should you?

Here's why financing is almost always better than paying cash

On paper, paying cash makes much more sense. You don't have to worry about a monthly payment, you don't pay a dime of interest, it's one-and-done.

However, there's an opportunity cost to paying cash.

If you write Carmax a check for $15,000, that's now $15,000 that you can't invest and multiply.

To illustrate, let's say you choose to finance instead of paying cash. You put 20% or $3,000 down, and set up autopay for your $300 monthly payment.

That leaves you with $12,000 today to play with.

- You could put it in an S&P 500 index fund where it could become $30,000 in five years.

- You could put it in your retirement account, where it could become $113,000 in 30 years.

As a general rule of thumb, it's usually worth financing at a 2% interest rate or lower and stashing the cash in other places where it can grow much faster. As a cherry on top, financing with a low interest rate is better for your credit score .

For ideas on where to invest your extra car cash, check out 7 easy ways to start investing with little money .

3 rules for financing a car

If you've established that financing is the right move for you, what are your next steps? What are some good rules of thumb to follow to ensure you get the best deal from your auto loan?

Put at least 20% down

The key objective of any loan is this: Don't go upside down.

You're "upside down" on a loan when you owe your lender more than the asset is worth — meaning that even if you sell it, you still owe money on something you don't even have anymore!

Yeah, upside down is not a fun place to be.

That's why you'll often see the number 20% thrown around when it comes to a car loan, a mortgage, etc. Large down payments not only help to reduce your monthly payments, and serve as a good litmus test as to whether you can afford the car — they also erect a dam to prevent you from going underwater.

Pick a loan term shorter than 48 months

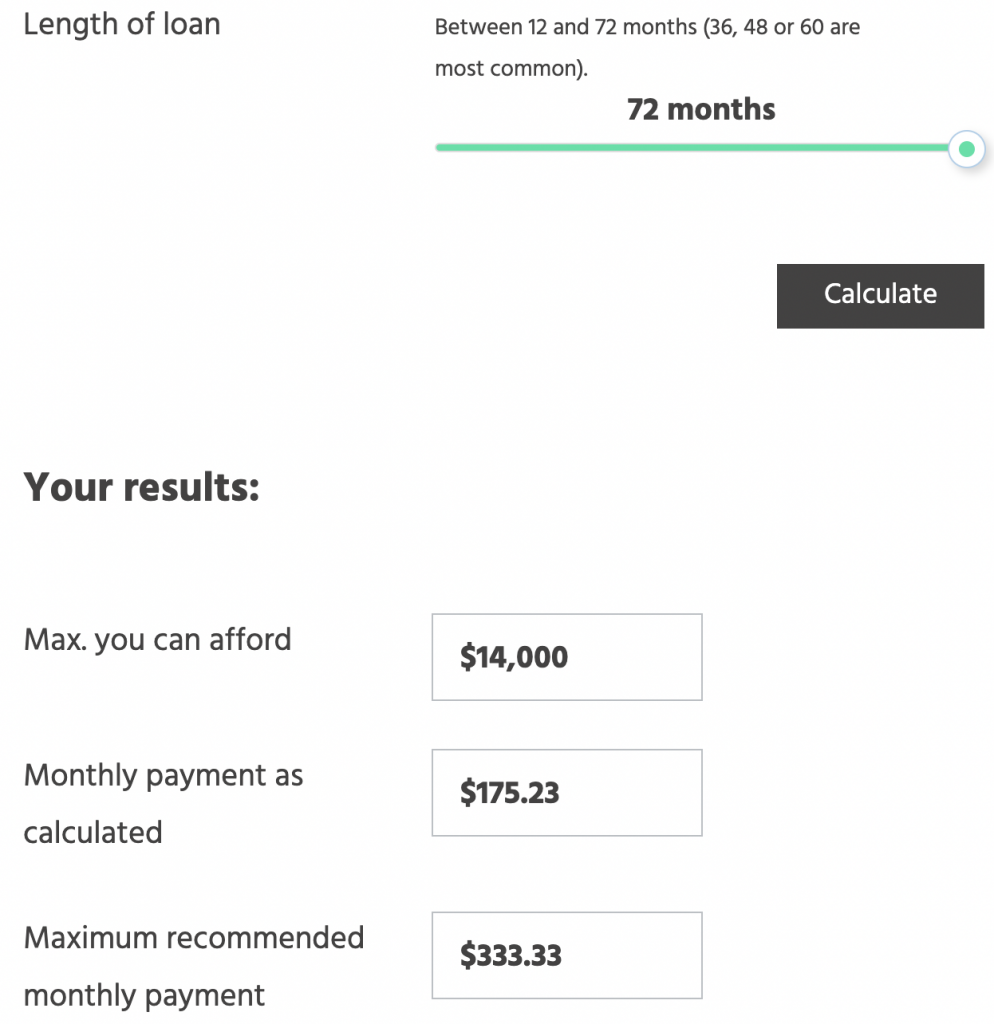

It might be tempting to push out your car loan term on the Car Affordability Calculator to lower your monthly payments. After all, in our earlier example, if we extend the term from 48 to 72 months, the monthly payment drops to just $175.23.

But pushing out your loan term means you pay much more in total .

To illustrate:

- 48 months X $252.89 monthly payment = $12,138.72.

- 72 months X $175.23 monthly payment = $12,616.56.

That's almost $500 more just in interest. Plus, that's two more years you might have to pay a lender's higher insurance requirements. Lastly, you don't want to still be paying off your car as its value plummets after four years, since the risk of going underwater goes higher.

Your total car monthly payment (interest, principal, sales tax, and insurance) should not exceed 10% of your gross monthly income

This is sort of a more granular version of the 35% rule.

The 35% (or less) rule gives you a general budget to plug into the search filters on Carmax, Edmunds, etc.

But when it comes down to brass tacks, you'll want to zero in on the monthly payment. Take your annual income, divide it by 120, and that's the most you'll want to pay for a car each month including insurance.

Read more: Tips for saving on your car loan

Here's why your budget is lower than you were hoping

If your reaction to the Car Affordability Calculator was:

Bruh – that's it? That's all I can spend on a car?

Well, you wouldn't be the first to feel that way.

I , too, felt that way back at my first job. Everyone I worked with was driving shiny new Mercedes-Benz and BMWs to work, while my budget calculations said I could only afford a used Mazda, at best.

I was making the same money as them, so… what gives ?

Why can't I afford a new Hemi-powered Charger or Lexus crossover like seemingly everyone else on the road?

The reality is that most Americans are driving cars that they can't really afford. For the first quarter of 2022, Edmunds reported that the average new car loan term was a horrifying 70 months, with the average monthly payment reaching $648 for new cars.

This tells us that rather than considering a more affordable car, Americans are pushing out their car loan terms even farther, staying in debt longer, and simply paying way, way too much overall.

Remember, you're sticking to the 35% rule for several reasons:

- You can still get top-rated crossovers, sports cars, etc. for under $15,000.

- You won't run the risk of going underwater.

- You'll be able to invest all the money you save, enabling you to achieve financial independence much faster (and even buy a much nicer car!).

5 tips for getting the best deal possible on a car

I've been buying cars for clients (and myself) for years. On average, I negotiate and save $3,100 on each car I buy. Dealerships have outright expressed their disdain for me, and their nasty texts and emails help me to sleep at night like warm tea.

You can read all of my secrets, as well as the best A-to-Z process for buying your first car, in my car buying guide.

In the meantime, here are some of my favorite and most effective tips I've put together over the years.

Shop around for car insurance

My first two car insurance quotes for my 2001 Mazda Miata were $200 and $1,000 for six months. Same car, same goober driving it — 400% price difference.

Every insurance provider sees each driver and car pairing differently, so it absolutely pays to shop around for at least five quotes. Check out our list of the best car insurance companies for young adults to compare multiple insurers so that you don't end up overpaying.

Buy used – seriously

A used car that's passed a pre-purchase inspection is nearly as good as a brand new car.

In some cases, it's even better. Generally speaking, a Toyota with 50,000 miles on it will outlast a VW, Fiat, or an Alfa Romeo with 0 miles on it. It all comes down to initial build quality, which some manufacturers emphasize more than others.

Used cars are also significantly cheaper (when there's not a chip shortage). As a general rule of thumb, cars lose at least 15% of their value each year — so if you're considering a Mazda3, look back just a few model years for a steep discount.

Don't pay a penny for dealer extras

Before you sign, dealerships will try to add "recommended extras" onto the invoice price. These typically include a $1,000 ceramic coat, $1,000 for a GPS anti-theft device, and $100 for nitrogen in the tires.

You can apply a ceramic coat yourself for $50, put an Apple AirTag under the seat for $29, and get free nitrogen at Costco (oxygen is also fine).

Oh, and ask to waive the "documentation fee." It's not a fake fee, but dealers charge too much and many will reduce or remove it upon request.

In fact, don't go to a dealership at all

For decades, car dealerships have employed seedy manipulation tactics like including hidden costs, undervaluing your trade-in, and telling outright lies just to get you in the door.

And now, with lower inventory and increasing pressure from Carmax and Carvana, they're getting bolder and more desperate.

You can still negotiate a good deal with dealerships, but you'll need to enter the lion's den ready to fight . For everyone else, Carmax is a much better choice.

Read more: Ex-car salesman tells all: how to beat the auto dealerships at their own game

Reliability is the best luxury

Finally, I'd urge you to make reliability one of your top considerations when buying a car. In addition to browsing the Consumer Reports reliability surveys, run any car that you're considering through The Edmunds Inc. True Cost to Own® tool .

Tinkering around with TCO® will reveal that while a fancy 4-Series BMW may cost less than a Mazda3 to buy , it costs over $20,000 more to own and maintain over five years.

Summary

The golden rule to car buying is to never spend more than 35% of your gross annual income on a car.

Now, your reaction may be eh, I was hoping I could spend more… but remember: There are a lot of used cars you can still get within your budget, and all the money you don't spend can be invested and multiplied.

If you're smart and frugal with your money, the Mazda you buy today can become the new Mercedes you drive tomorrow.

Read more:

- How much does it really cost to own your car? You'll be amazed

- The 5 biggest mistakes people make when buying a car

Related Tools

Save Your First - Or NEXT - $100,000

Sign Up for free weekly money tips to help you earn and save more

We commit to never sharing or selling your personal information.

Source: https://www.moneyunder30.com/car-affordability-calculator

0 Response to "Car Calculator Funny Cars for Sale"

إرسال تعليق